This is for you JK.

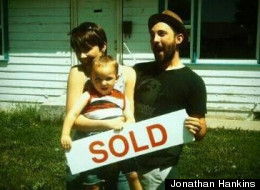

Jonathan Hankins, his wife and son with the "Sold" sign for

their new home. The building was laced with methamphetamine residue and

the family had to abandon their home, Hankins said.

Last March, a 23-year-old bank contractor cut through the

secured gate at the entrance to a farm in Little Rock, Ark., and

proceeded to a small house on the property. There, according to a police

report, he broke the lock off one of the doors and forced his way

inside.

The man, who police would later identify as David Cole, was allegedly there on official business: He worked in a little-known but booming industry that maintains and inspects millions of foreclosed and abandoned homes owned by mortgage lenders in the wake of an epochal real estate bust. The bank responsible for this particular home had presumably decided that the home was another discarded mess, and Cole's company had been dispatched to shore the building against the ravages of weather and decay.

The owner of the property, a recently widowed woman named Marie Osborne, acknowledges that she was indeed in foreclosure. She was away when Cole arrived, she said. Still, the house was very much hers and far from abandoned, as even a cursory review would have made clear, according to a lawsuit she subsequently filed.

When she returned home, Osborne was "astonished" to discover that her doors had been padlocked and her belongings ransacked, she claims. A grandfather clock was missing, along with an antique gold mirror, several televisions and family photos, Osborne alleges.

Osborne filed the lawsuit against those she asserts are responsible -- Safeguard Properties, a Valley View, Ohio-based firm that has quietly become a giant in the business of tending to abandoned properties, and Daryl Cole, proprietor of Cole & Sons, a local business that was supposedly acting as a subcontractor.

Neither Daryl Cole nor his son David returned requests for comment. Safeguard declined to comment, citing pending litigation. In response to a general question about the merits of dozens of lawsuits against the company -- and scores of similar complaints lodged against others in the same line of work -- a spokeswoman noted that Safeguard completed more than 14 million work orders last year.

“That isn’t to minimize the lawsuits, because our goal would be zero,” the spokeswoman said. Even so, she added, instances like these are “extremely rare.”

But

accounts such as Osborne’s have become familiar as the "field services"

industry sifts through the wreckage of a monumental wave of reckoning

that has seen some 10 million homes slide into foreclosure since 2006.

An investigation by The Huffington Post featuring interviews with more

than two dozen independent bank contractors and a review of more than

100 lawsuits reveals that the industry, which experts estimate booked

more than $2 billion in revenue last year, is plagued by allegations of

misconduct and abuse.

According lawsuits and police reports drawn from communities nationwide, contractors have emptied lived-in homes of all possessions, including jewelry, heirlooms, and -- in at least one instance -- the family cat. They have allegedly dumped trash illegally rather than paying for disposal, and have been accused of painting over potentially hazardous mold instead of removing it. They have allegedly forged paperwork, and used doctored photographs to bill banks and the federal government for services never performed.

“I’ve walked into houses that someone else was supposed to take care of that were in horrible shape,” said Mimi Norris, who owns JR Services, a small company in Ohio that hires contractors to inspect and repair homes. “I have gone to inspect properties reported as vacant that were still occupied. This happens too often.”

The troubles emanating from the home inspection and repair business are the product of unique forces that generated the business at hand. The same banks that contributed to the real estate bubble via overly aggressive, lightly supervised mortgage lending now confront a glut of overgrown, vacant, and damaged homes.

Some of these homes are foreclosed and owned by mortgage companies; others are abandoned but still in legal possession of the former owners. The banks also dispatch contractors to the homes of people who have fallen 45 days or more behind on their payments but are not in foreclosure to determine if they have been abandoned. All told, an estimated 3.3 million properties require either an inspection or some form of repair work each month.

A foreclosed home in Cincinnati. Contractors inspect or repair an estimated 3.3 million homes like this one each month.

Many of the contractors willing to engage in the dirty work of cleaning and repairing these homes have landed there by way of joblessness -- among them laid-off loan officers and other mortgage industry refugees striving to make an honest living in a bad economy.

Others are felons or cheats drawn to a sector that boomed after the housing bubble popped, seeking opportunity in an industry with a history of underpaying its workers and neglecting background checks. Fierce competition among the businesses that hire these contractors and weak supervision by banks and federal agencies have prompted some workers to take shortcuts and to do work they are not licensed to do.

Adam Reynolds, a Naples, Fla., contractor who ran a field services company called REO Proz until it folded last year, said he was routinely dispatched by banks or larger field services companies to drill out locks to see whether properties were vacant, only to find that tenants still lived there and had never missed a payment.

“Countless times," he said, he received orders to clean out properties that had personal photos on the shelves and fresh food in the refrigerator.

"I've even had an order sending me to a property that was never owned by any bank," he said. "I know it has got to be painstaking at the top to keep tabs on everyone, but these errors are life-changing for some people.”

For the contractors, the work is by turns grim and dangerous. Entering other people's property armed with nothing more than flashlights, they sometimes encounter squatters and criminals who use boarded-up properties as drug dens, sometimes provoking violent confrontations.

“I’ve been chased by dogs, I’ve been spat at, I’ve had things thrown at me,” said Mary Sisson a mother of three who inspects abandoned homes in the suburbs of New York City. “I’ve walked in on gang members.”

The full costs of the industry’s shortcomings are borne by more than immediate victims: The consequences ripple out to surrounding communities. Shoddy repair work allows homes to disintegrate into eyesores and neighborhood hazards, attracting vagrants, junkies and thieves who tear out installations such as copper wiring. Pipes burst, filling basements with water, while broken windows allow rain to penetrate, spawning the growth of dangerous mold. Lawns grow into burgeoning forests, giving cover to destructive rodents and pests.

In Klamath Falls, Ore., Jonathan Hankins, his wife and young son said they were forced to abandon the home they bought from Freddie Mac last year after they started suffering from nosebleeds, respiratory problems and mouth sores. A home testing kit revealed that parts of the house were contaminated with 76 times the allowable maximum level of methamphetamine residue, Hankins said. A local realtor hired to clean out the property never reported that the home was used as a drug lab, Hankins said.

Last year, Secret Service agents working with the Federal Housing Finance Agency raided American Mortgage Field Services in Brooksville, Fla., north of Tampa. The owner recently pleaded guilty to creating fraudulent inspection reports for work that was never done over a three-year period, overbilling Bank of America, which hired the company to inspect Fannie Mae and Freddie Mac properties, by $12.7 million.

In addition to Fannie, Freddie and other mortgage companies, many abandoned and foreclosed homes are owned directly by the federal government, including the U.S. Department of Housing and Urban Development, which also hires contractors to watch over the homes. An audit last September by HUD's Office of Inspector General found that 60 percent of sampled homes were not properly maintained. The auditor who checked up on one home, near Santa Ana, Calif., commented in field notes that the property was "filthy" with "broken windows, roaches and hair in [the] sink" even though it was supposedly inspected just two days before by a contractor hired by HUD.

The most common problem appears to be inspectors breaking into still-occupied homes. Contractors are regularly dispatched to secure houses against damage from cold weather or to perform so-called "trash outs" in which they empty homes of belongings. Several contractors told The Huffington Post that they have frequently been sent on such jobs only to find on arrival that the legal owner still lives in the house. Most leave after they force their way inside and find family photos and other evidence that indicate a house is still occupied by its owner. Some do not.

PIRATE MENTALITY

In Whippany, N.J., Lynn Stringas claims that contractors working for CoreLogic Field Services, a Westlake, Texas-based company working for Wells Fargo, forced their way into her home three separate times. Like many others who have had run-ins with bank contractors, her home was in the foreclosure process, but she was still the legal owner.

The last break-in came after Stringas and her attorney called the bank repeatedly, pleading that they stop, she said. On that final occasion, Stringas claims, the contractors kicked in the front door and dumped boxes of papers she had left in her kitchen throughout her house.

“I felt like I was going to have a nervous breakdown,” Stringas said.

In Punta Gorda, Fla., a Canadian couple vacationing in a rental home returned from a day at the beach to discover that their laptop computer, iPod and six bottles of wine were missing, according to a lawsuit by the owner filed in Florida circuit court.

A contractor, Victor Titenko, was sent by a field services company called Core Logic after someone wrongly determined the house was abandoned. According to a police report, Titenko denied taking the belongings, and also denied opening the refrigerator and removing a beer, though a can of beer bearing his fingerprints was found open on a counter.

Titenko could not be located for comment. Public records reveal that he has been arrested at least six times in Florida for burglary and robbery, along with larceny, narcotics possession and attempting to sell stolen goods. CoreLogic declined to comment.

“The banking industry has a pirate mentality,” said Matthew Weidner, an attorney in Sarasota, Fla., who has represented scores of homeowners in lawsuits against field services companies. “They take the position that if you have a mortgage, they can break down your door whenever they want.”

As Marie Osborne tells it, the presence of the valuables left in her Arkansas farmhouse should have been enough to establish clearly that her home was not abandoned. She claims in her lawsuit that anyone could have quickly surmised that her home was still occupied, given how family and workers were coming and going on a daily basis. A check of the electric and gas meters would have shown that utilities were turned on, she said.

The farm in Arkansas, as shown on Google Maps.

Osborne's account was confirmed by Lt. Jeff Allison, a Little Rock police detective who investigated the case. Allison estimated the value of the missing items at "several hundred thousand dollars," noting that some had belonged to movie stars and presidents. There was "no reason to think" the home was abandoned, Allison said. "You could have walked in and lived there that day."

Osborne's late-husband, William Jennings Osborne, made a fortune in the medical research industry. He was known both for his philanthropy and for his lavish Christmas light display, which attracted national attention and traffic jams so awful that neighbors eventually sued to halt the festivities. When he died in 2011, he left behind large debts, including an unpaid mortgage on the house, one of several that he owned. The homes would later sell at auction. But at the time of Cole’s visit, Marie Osborne was the legal owner of the horse farm.

Cole was arrested and is set to stand trial in the next few months on a burglary charge. According to police, he worked for a company owned by his father, Daryl Cole. According to public records, Daryl Cole is a convicted sex offender who pled guilty in 2008 to using the Web to solicit an officer who was posing as a 14-year-old girl.

Allison said that the elder Cole told police that his son told him he had burned the televisions. None of the items from the house were recovered.

Whether Cole & Sons worked directly for Safeguard or indirectly through another contractor cannot be determined from public records. But the very fact that the company was dispatched to attend to Osborne's property highlights what critics portray as a major problem with the industry: scant background checks to ensure that people without criminal backgrounds are sent into other people’s homes.

A Safeguard spokeswoman said the company requires background checks for the "business principals" of direct vendors it hires, and expects them to do the same with employees and subcontractors they might use.

Plaintiffs' lawyers allege that companies like Safeguard, and the banks and federal agencies that hire them, are failing in their obligation to oversee the low-paid, little-trained and itinerant workers who often actually do the jobs. Several bank agents told the HuffPost that while many contractors appear to be scrupulous and careful, sloppy mistakes and dangerous shortcuts amount to routine events.

"Out here in the field there is no oversight," said Brent Johnson, an Iowa-based contractor who has worked in the industry for 15 years. "This is the Wild West. The American public is buying homes at a reduced cost and thinking they are getting a good deal, but they are buying nightmares."

NOT WORTH THE DANGER

Two decades ago, banks themselves generally took care of foreclosed and abandoned properties. But as the mortgage industry grew, lenders began parceling out the work to a handful of large field services companies, which established networks of subcontractors in states across the country.

The housing crash and subsequent increase in foreclosures dramatically enhanced demand for such services. At the end of 2007, Fannie Mae and Freddie Mac, the two government-controlled mortgage companies that together own or guarantee roughly half of all mortgages in the United States, held 48,000 foreclosed homes on their own ledgers. By the end of 2010, that number had grown almost fivefold to 235,000.

As of January, 1.5 million homes were in the foreclosure process or were owned by banks or a federal agency, according to RealtyTrac, an online real estate data company. In addition, 1.8 million homeowners were delinquent by at least 60 days on their mortgages, according to the Mortgage Bankers Association. These numbers have remained high even as the housing market has more broadly shown recent signs of recovery.

The swelling numbers of foreclosed and abandoned homes -- along with those that are still occupied but in default, requiring a monthly inspection to verify occupancy -- created a rare job opportunity for mortgage industry castaways. In the years since the crash, more than 10,000 have filled the ranks of the field contracting services industry, knocking on doors, taking photos of front lawns and repairing broken windows and toilets -- often at the same homes they built or helped finance only a few years earlier.

“All of a sudden we saw an enormous influx of people wanting to get in on the money and not really knowing what they were doing," said Norris, who owns the Ohio property inspection company.

Many of these contractors started small businesses with the aim of capturing some share of the work flowing from the largest field services companies, a group that includes Safeguard, Corelogic, Lender Processing Services in Jacksonville, Fla., and Cyprexx Services in Bradenton, Fla. These small companies, in turn, often hire contractors of their own, which sometimes farm the work out yet again.

With each layer of subcontracting, though, oversight tends to diminish along with compensation, generating pressure and opportunity to cut corners, contractors said.

“There can be two or three companies between you and the bank taking chunks of this money out for doing nothing but shuffling paperwork,” said Wayne Frazier, a general contractor in Maryland.

The trickle-down effect often means that banks and taxpayers aren’t getting much for each dollar spent. The federal Department of Housing and Urban Development pays a maximum of $30 for an initial home inspection and $20 for each subsequent inspection, according to agency pricing sheets.

Angie Montgomery in Cincinnati said she earns $3 per inspection -- $4 if the job requires that she go inside a house. Out of that, she must pay for gas and car maintenance, along with liability insurance premiums. She must also contend, she said, with angry homeowners who see her as an agent of the same bank that they are fighting with to avoid foreclosure. She has been yelled at, bitten by dogs and once entered a home where the vindictive former owner had cut a hole in the floor, then covered it with a carpet, she said.

Angie Montgomery, a property inspector in Cincinnati, snaps a photo of a vacant home.

A Craigslist search for "property inspector" turned up dozens of ads looking for people to inspect homes for as little as $1 or $2 per job. For so little money, inspectors often don't bother to get out of their cars, let alone knock on doors, talk to neighbors or check to see if utilities are turned on, experienced contractors said.

The same market forces that have brought down pay for home inspections have bled into the other types of cleaning and repair work contractors commonly do.

Buczek Enterprises, a company in Derby, N.Y., advertises that it will pay $30 to mow grass up to a foot high, and on a lawn up to 10,000 square feet, or a little bit bigger than a baseball diamond. Rates that low may not even cover travel time and fuel costs, experienced contractors said.

Many contractors facing this pay squeeze said they have simply stopped accepting such jobs, concluding that the meager pay is not worth the risk or hassle.

“I’m an Iraq and Afghanistan veteran,” said Sean Dougherty, a contractor in Pennsylvania. “And it is more hostile here working for these companies.”

UNSCRUPULOUS MONEY

With both oversight and pay at a minimum, the conditions are ripe for those willing to cut corners and commit fraud, industry veterans said.

The most prevalent form of misconduct is the practice of simply charging for work done poorly, or not done at all, a HuffPost review found. Though field services contractors are required to submit photographs documenting their work, follow-up inspections indicate this form of verification is not always sufficient, or is sometimes falsified.

An audit by HUD's Inspector General last September found that one Las Vegas field services company, Innotion Enterprises, had failed to maintain "at a high standard of care" more than one-third of the properties audited.

At one home, HUD auditors discovered weeds that were four feet high -- even though a photo submitted 13 days before showed a contractor pulling weeds. During another review, an HUD auditor found that a contractor who claimed to have installed safety rails on a front porch had not bothered to attach them with screws or nails to hold them in place. The cost to HUD for this botched work: approximately $360 per home, per month.

A phone number for Innotion was disconnected.

Another HUD Inspector General audit -- the one that determined that 60 percent of sampled homes were not properly maintained -- also found that HUD continued to dole out contracts to companies after the agency had identified performance issues with those same companies.

The report concluded that the agency “did not have adequate procedures in place to ensure consistent and adequate enforcement” of contracts.

“Every concern raised by the Office of the Inspector in the [audit] has been addressed," said Jerry Brown, a HUD spokesman in a statement. "We have started working on the fixes and we anticipate they will be completed by Sept. 30, 2013. The OIG has been briefed on our plan and is fully aware of our commitment to right the wrongs."

Though HUD oversees a relatively small number of abandoned and vacant homes -- about 40,000 at any given time -- experienced contractors said the same issues are at play throughout the industry. Bruce Davenport, a Georgia contractor who fixes up vacant homes, estimated that 70 percent of the properties he visits show signs of jobs half-done, or not done at all.

Sometimes the evidence of misconduct is apparent to anyone who happens by a foreclosed home.

In Lehigh Acres, a Florida exurb among the hardest hit by the foreclosure crisis, police arrested Don Zilen in 2011 after he admitted to illegally dumping more than 10,000 pounds of trash that he pulled out of two homes into the backyard of a vacant house near where he lived.

According to a pay record for the job -- which Zilen also unwisely dumped -- Fannie Mae had hired Cyprexx Services to clean out the houses. Cyprexx hired a local company, REO Proz, which hired Zilen.

Adam Reynolds, the former owner of REO Proz, told HuffPost that licensed dumpsites charge to accept waste, so Zilen likely calculated that he could save a few hundred dollars by emptying the trash in someone's backyard. Reynolds said that Zilen had passed a background check, but acknowledged that he did not perform such checks on all subcontractors. "Sometimes we hired them on a whim," he said.

'REASONABLE EFFORTS'

The failure by the industry to consistently vet contractors echoes practices that led to past investigations and rule-changes. In 2005, for example, a South Florida Sun-Sentinel investigation found that government inspectors entrusted to verify damage claims for the Federal Emergency Management Agency included criminals with records for embezzlement, drug dealing and robbery. FEMA subsequently tightened its screening requirements.

HUD did not respond to requests for comment about what steps the agency takes to vet its contractors. Broadly, regulations that govern federal contracts require "reasonable efforts" to not include an individual as a "principal" whom "due diligence would have exposed as having engaged in conduct that is in conflict with the contractor’s code of business ethics and conduct."

In the case of one Atlanta field services company, a simple background check may have prevented what some contractors allege was a short-lived, but costly scam.

Brandon Lambert and his business partner, Jason Mathis, opened Premier Property Management Services last August using $70,000 in seed money from a local businessman, Mike Edwards, as starting capital.

Registration papers indicate that Lambert was chief financial officer for the company. He is also a convicted felon, having served two stints in prison for check fraud and forging documents, according to public records.

Over a three-month span, Lambert and Mathis hired contractors to clean and preserve hundreds of properties. In October, the company abruptly shut its doors.

Seven former contractors who maintained homes for the company allege that Lambert and Mathis owe tens of thousands of dollars for work that was done, but not paid for. Two of the contractors have filed claims in Atlanta courts. Edwards said that he hasn't recovered any of his investment money.

Premier Property was a middleman, or an "order mill" as some contractors call these companies. At least least half a dozen larger field services companies hired it to clean out and preserve properties for entities including HUD, according to contractors who spoke to HuffPost.

It's not clear what steps, if any, these companies take to vet the contractors they hire to carry out work orders.

Asset Management Services, or AMS, in Bristol, Pa., is one of the companies that hired Premier Property to maintain foreclosed homes, several contractors said. On its website, AMS boasts that its “highly skilled and trained property technicians manage thousands of assets across the nation.”

AMS did not respond to a request for comment. Beth Meade, a former AMS employee hired in the fall of 2011, said almost all of her colleagues were temporary workers earning minimum wage and that they received little training. She said she was assigned with one other worker to oversee a portfolio of 125 properties in northern Florida owned by the Federal Deposit Insurance Corp., which had taken title to them after a bank failure.

Meade said she hired contractors to inspect and preserve homes by searching “general contractors” and “Florida” using Google. She said she didn’t know if the contractors she hired had criminal pasts or whether they were licensed to do repair work -- or even whether there is a licensing requirement in Florida.

In an interview, Edwards said that he should have known better than to loan Lambert and Mathis money without better vetting their backgrounds. He said that he cut off the funding after it seemed clear that Lambert was "making up numbers." He said he did not expect to be repaid and that he is not pursuing legal action, having concluded it would be fruitless.

Opinions differ on what happened: Edwards said he thinks Mathis and Lambert were simply bad businessmen; former contractors told HuffPost they believe the pair intentionally cheated them.

After Premier Property collapsed -- or was looted -- Mathis and Lambert appear to have stayed in the Atlanta area.

In December, a Georgia company called American Contracting Consultants Inc. listed Mathis as its "registered agent" in public filings. Antwane Adams, also listed as a registered agent of the company, told HuffPost that he is a childhood friend of Mathis. Adams said the business came about after Mathis approached with an opportunity: If he and his wife would pitch in just a few thousand dollars, Mathis and Lambert would help them launch a new business in the property preservation industry. Adams said he did not know anything about the industry prior to the proposal.

In January, Adams said, he began hearing from contractors who claimed the two men owed them money. When confronted with the allegations, Mathis and Lambert "up and disappeared," Adams said, taking with them tools and other equipment.

Adams said he was working to remove Mathis's name from registration documents. "We've been getting a lot of grief about this," he said.

The man, who police would later identify as David Cole, was allegedly there on official business: He worked in a little-known but booming industry that maintains and inspects millions of foreclosed and abandoned homes owned by mortgage lenders in the wake of an epochal real estate bust. The bank responsible for this particular home had presumably decided that the home was another discarded mess, and Cole's company had been dispatched to shore the building against the ravages of weather and decay.

The owner of the property, a recently widowed woman named Marie Osborne, acknowledges that she was indeed in foreclosure. She was away when Cole arrived, she said. Still, the house was very much hers and far from abandoned, as even a cursory review would have made clear, according to a lawsuit she subsequently filed.

When she returned home, Osborne was "astonished" to discover that her doors had been padlocked and her belongings ransacked, she claims. A grandfather clock was missing, along with an antique gold mirror, several televisions and family photos, Osborne alleges.

Osborne filed the lawsuit against those she asserts are responsible -- Safeguard Properties, a Valley View, Ohio-based firm that has quietly become a giant in the business of tending to abandoned properties, and Daryl Cole, proprietor of Cole & Sons, a local business that was supposedly acting as a subcontractor.

Neither Daryl Cole nor his son David returned requests for comment. Safeguard declined to comment, citing pending litigation. In response to a general question about the merits of dozens of lawsuits against the company -- and scores of similar complaints lodged against others in the same line of work -- a spokeswoman noted that Safeguard completed more than 14 million work orders last year.

“That isn’t to minimize the lawsuits, because our goal would be zero,” the spokeswoman said. Even so, she added, instances like these are “extremely rare.”

According lawsuits and police reports drawn from communities nationwide, contractors have emptied lived-in homes of all possessions, including jewelry, heirlooms, and -- in at least one instance -- the family cat. They have allegedly dumped trash illegally rather than paying for disposal, and have been accused of painting over potentially hazardous mold instead of removing it. They have allegedly forged paperwork, and used doctored photographs to bill banks and the federal government for services never performed.

“I’ve walked into houses that someone else was supposed to take care of that were in horrible shape,” said Mimi Norris, who owns JR Services, a small company in Ohio that hires contractors to inspect and repair homes. “I have gone to inspect properties reported as vacant that were still occupied. This happens too often.”

The troubles emanating from the home inspection and repair business are the product of unique forces that generated the business at hand. The same banks that contributed to the real estate bubble via overly aggressive, lightly supervised mortgage lending now confront a glut of overgrown, vacant, and damaged homes.

Some of these homes are foreclosed and owned by mortgage companies; others are abandoned but still in legal possession of the former owners. The banks also dispatch contractors to the homes of people who have fallen 45 days or more behind on their payments but are not in foreclosure to determine if they have been abandoned. All told, an estimated 3.3 million properties require either an inspection or some form of repair work each month.

Many of the contractors willing to engage in the dirty work of cleaning and repairing these homes have landed there by way of joblessness -- among them laid-off loan officers and other mortgage industry refugees striving to make an honest living in a bad economy.

Others are felons or cheats drawn to a sector that boomed after the housing bubble popped, seeking opportunity in an industry with a history of underpaying its workers and neglecting background checks. Fierce competition among the businesses that hire these contractors and weak supervision by banks and federal agencies have prompted some workers to take shortcuts and to do work they are not licensed to do.

Adam Reynolds, a Naples, Fla., contractor who ran a field services company called REO Proz until it folded last year, said he was routinely dispatched by banks or larger field services companies to drill out locks to see whether properties were vacant, only to find that tenants still lived there and had never missed a payment.

“Countless times," he said, he received orders to clean out properties that had personal photos on the shelves and fresh food in the refrigerator.

"I've even had an order sending me to a property that was never owned by any bank," he said. "I know it has got to be painstaking at the top to keep tabs on everyone, but these errors are life-changing for some people.”

For the contractors, the work is by turns grim and dangerous. Entering other people's property armed with nothing more than flashlights, they sometimes encounter squatters and criminals who use boarded-up properties as drug dens, sometimes provoking violent confrontations.

“I’ve been chased by dogs, I’ve been spat at, I’ve had things thrown at me,” said Mary Sisson a mother of three who inspects abandoned homes in the suburbs of New York City. “I’ve walked in on gang members.”

The full costs of the industry’s shortcomings are borne by more than immediate victims: The consequences ripple out to surrounding communities. Shoddy repair work allows homes to disintegrate into eyesores and neighborhood hazards, attracting vagrants, junkies and thieves who tear out installations such as copper wiring. Pipes burst, filling basements with water, while broken windows allow rain to penetrate, spawning the growth of dangerous mold. Lawns grow into burgeoning forests, giving cover to destructive rodents and pests.

In Klamath Falls, Ore., Jonathan Hankins, his wife and young son said they were forced to abandon the home they bought from Freddie Mac last year after they started suffering from nosebleeds, respiratory problems and mouth sores. A home testing kit revealed that parts of the house were contaminated with 76 times the allowable maximum level of methamphetamine residue, Hankins said. A local realtor hired to clean out the property never reported that the home was used as a drug lab, Hankins said.

Last year, Secret Service agents working with the Federal Housing Finance Agency raided American Mortgage Field Services in Brooksville, Fla., north of Tampa. The owner recently pleaded guilty to creating fraudulent inspection reports for work that was never done over a three-year period, overbilling Bank of America, which hired the company to inspect Fannie Mae and Freddie Mac properties, by $12.7 million.

In addition to Fannie, Freddie and other mortgage companies, many abandoned and foreclosed homes are owned directly by the federal government, including the U.S. Department of Housing and Urban Development, which also hires contractors to watch over the homes. An audit last September by HUD's Office of Inspector General found that 60 percent of sampled homes were not properly maintained. The auditor who checked up on one home, near Santa Ana, Calif., commented in field notes that the property was "filthy" with "broken windows, roaches and hair in [the] sink" even though it was supposedly inspected just two days before by a contractor hired by HUD.

The most common problem appears to be inspectors breaking into still-occupied homes. Contractors are regularly dispatched to secure houses against damage from cold weather or to perform so-called "trash outs" in which they empty homes of belongings. Several contractors told The Huffington Post that they have frequently been sent on such jobs only to find on arrival that the legal owner still lives in the house. Most leave after they force their way inside and find family photos and other evidence that indicate a house is still occupied by its owner. Some do not.

PIRATE MENTALITY

In Whippany, N.J., Lynn Stringas claims that contractors working for CoreLogic Field Services, a Westlake, Texas-based company working for Wells Fargo, forced their way into her home three separate times. Like many others who have had run-ins with bank contractors, her home was in the foreclosure process, but she was still the legal owner.

The last break-in came after Stringas and her attorney called the bank repeatedly, pleading that they stop, she said. On that final occasion, Stringas claims, the contractors kicked in the front door and dumped boxes of papers she had left in her kitchen throughout her house.

“I felt like I was going to have a nervous breakdown,” Stringas said.

In Punta Gorda, Fla., a Canadian couple vacationing in a rental home returned from a day at the beach to discover that their laptop computer, iPod and six bottles of wine were missing, according to a lawsuit by the owner filed in Florida circuit court.

A contractor, Victor Titenko, was sent by a field services company called Core Logic after someone wrongly determined the house was abandoned. According to a police report, Titenko denied taking the belongings, and also denied opening the refrigerator and removing a beer, though a can of beer bearing his fingerprints was found open on a counter.

Titenko could not be located for comment. Public records reveal that he has been arrested at least six times in Florida for burglary and robbery, along with larceny, narcotics possession and attempting to sell stolen goods. CoreLogic declined to comment.

“The banking industry has a pirate mentality,” said Matthew Weidner, an attorney in Sarasota, Fla., who has represented scores of homeowners in lawsuits against field services companies. “They take the position that if you have a mortgage, they can break down your door whenever they want.”

As Marie Osborne tells it, the presence of the valuables left in her Arkansas farmhouse should have been enough to establish clearly that her home was not abandoned. She claims in her lawsuit that anyone could have quickly surmised that her home was still occupied, given how family and workers were coming and going on a daily basis. A check of the electric and gas meters would have shown that utilities were turned on, she said.

Osborne's account was confirmed by Lt. Jeff Allison, a Little Rock police detective who investigated the case. Allison estimated the value of the missing items at "several hundred thousand dollars," noting that some had belonged to movie stars and presidents. There was "no reason to think" the home was abandoned, Allison said. "You could have walked in and lived there that day."

Osborne's late-husband, William Jennings Osborne, made a fortune in the medical research industry. He was known both for his philanthropy and for his lavish Christmas light display, which attracted national attention and traffic jams so awful that neighbors eventually sued to halt the festivities. When he died in 2011, he left behind large debts, including an unpaid mortgage on the house, one of several that he owned. The homes would later sell at auction. But at the time of Cole’s visit, Marie Osborne was the legal owner of the horse farm.

Cole was arrested and is set to stand trial in the next few months on a burglary charge. According to police, he worked for a company owned by his father, Daryl Cole. According to public records, Daryl Cole is a convicted sex offender who pled guilty in 2008 to using the Web to solicit an officer who was posing as a 14-year-old girl.

Allison said that the elder Cole told police that his son told him he had burned the televisions. None of the items from the house were recovered.

Whether Cole & Sons worked directly for Safeguard or indirectly through another contractor cannot be determined from public records. But the very fact that the company was dispatched to attend to Osborne's property highlights what critics portray as a major problem with the industry: scant background checks to ensure that people without criminal backgrounds are sent into other people’s homes.

A Safeguard spokeswoman said the company requires background checks for the "business principals" of direct vendors it hires, and expects them to do the same with employees and subcontractors they might use.

Plaintiffs' lawyers allege that companies like Safeguard, and the banks and federal agencies that hire them, are failing in their obligation to oversee the low-paid, little-trained and itinerant workers who often actually do the jobs. Several bank agents told the HuffPost that while many contractors appear to be scrupulous and careful, sloppy mistakes and dangerous shortcuts amount to routine events.

"Out here in the field there is no oversight," said Brent Johnson, an Iowa-based contractor who has worked in the industry for 15 years. "This is the Wild West. The American public is buying homes at a reduced cost and thinking they are getting a good deal, but they are buying nightmares."

NOT WORTH THE DANGER

Two decades ago, banks themselves generally took care of foreclosed and abandoned properties. But as the mortgage industry grew, lenders began parceling out the work to a handful of large field services companies, which established networks of subcontractors in states across the country.

The housing crash and subsequent increase in foreclosures dramatically enhanced demand for such services. At the end of 2007, Fannie Mae and Freddie Mac, the two government-controlled mortgage companies that together own or guarantee roughly half of all mortgages in the United States, held 48,000 foreclosed homes on their own ledgers. By the end of 2010, that number had grown almost fivefold to 235,000.

As of January, 1.5 million homes were in the foreclosure process or were owned by banks or a federal agency, according to RealtyTrac, an online real estate data company. In addition, 1.8 million homeowners were delinquent by at least 60 days on their mortgages, according to the Mortgage Bankers Association. These numbers have remained high even as the housing market has more broadly shown recent signs of recovery.

The swelling numbers of foreclosed and abandoned homes -- along with those that are still occupied but in default, requiring a monthly inspection to verify occupancy -- created a rare job opportunity for mortgage industry castaways. In the years since the crash, more than 10,000 have filled the ranks of the field contracting services industry, knocking on doors, taking photos of front lawns and repairing broken windows and toilets -- often at the same homes they built or helped finance only a few years earlier.

“All of a sudden we saw an enormous influx of people wanting to get in on the money and not really knowing what they were doing," said Norris, who owns the Ohio property inspection company.

Many of these contractors started small businesses with the aim of capturing some share of the work flowing from the largest field services companies, a group that includes Safeguard, Corelogic, Lender Processing Services in Jacksonville, Fla., and Cyprexx Services in Bradenton, Fla. These small companies, in turn, often hire contractors of their own, which sometimes farm the work out yet again.

With each layer of subcontracting, though, oversight tends to diminish along with compensation, generating pressure and opportunity to cut corners, contractors said.

“There can be two or three companies between you and the bank taking chunks of this money out for doing nothing but shuffling paperwork,” said Wayne Frazier, a general contractor in Maryland.

The trickle-down effect often means that banks and taxpayers aren’t getting much for each dollar spent. The federal Department of Housing and Urban Development pays a maximum of $30 for an initial home inspection and $20 for each subsequent inspection, according to agency pricing sheets.

Angie Montgomery in Cincinnati said she earns $3 per inspection -- $4 if the job requires that she go inside a house. Out of that, she must pay for gas and car maintenance, along with liability insurance premiums. She must also contend, she said, with angry homeowners who see her as an agent of the same bank that they are fighting with to avoid foreclosure. She has been yelled at, bitten by dogs and once entered a home where the vindictive former owner had cut a hole in the floor, then covered it with a carpet, she said.

A Craigslist search for "property inspector" turned up dozens of ads looking for people to inspect homes for as little as $1 or $2 per job. For so little money, inspectors often don't bother to get out of their cars, let alone knock on doors, talk to neighbors or check to see if utilities are turned on, experienced contractors said.

The same market forces that have brought down pay for home inspections have bled into the other types of cleaning and repair work contractors commonly do.

Buczek Enterprises, a company in Derby, N.Y., advertises that it will pay $30 to mow grass up to a foot high, and on a lawn up to 10,000 square feet, or a little bit bigger than a baseball diamond. Rates that low may not even cover travel time and fuel costs, experienced contractors said.

Many contractors facing this pay squeeze said they have simply stopped accepting such jobs, concluding that the meager pay is not worth the risk or hassle.

“I’m an Iraq and Afghanistan veteran,” said Sean Dougherty, a contractor in Pennsylvania. “And it is more hostile here working for these companies.”

UNSCRUPULOUS MONEY

With both oversight and pay at a minimum, the conditions are ripe for those willing to cut corners and commit fraud, industry veterans said.

The most prevalent form of misconduct is the practice of simply charging for work done poorly, or not done at all, a HuffPost review found. Though field services contractors are required to submit photographs documenting their work, follow-up inspections indicate this form of verification is not always sufficient, or is sometimes falsified.

An audit by HUD's Inspector General last September found that one Las Vegas field services company, Innotion Enterprises, had failed to maintain "at a high standard of care" more than one-third of the properties audited.

At one home, HUD auditors discovered weeds that were four feet high -- even though a photo submitted 13 days before showed a contractor pulling weeds. During another review, an HUD auditor found that a contractor who claimed to have installed safety rails on a front porch had not bothered to attach them with screws or nails to hold them in place. The cost to HUD for this botched work: approximately $360 per home, per month.

A phone number for Innotion was disconnected.

Another HUD Inspector General audit -- the one that determined that 60 percent of sampled homes were not properly maintained -- also found that HUD continued to dole out contracts to companies after the agency had identified performance issues with those same companies.

The report concluded that the agency “did not have adequate procedures in place to ensure consistent and adequate enforcement” of contracts.

“Every concern raised by the Office of the Inspector in the [audit] has been addressed," said Jerry Brown, a HUD spokesman in a statement. "We have started working on the fixes and we anticipate they will be completed by Sept. 30, 2013. The OIG has been briefed on our plan and is fully aware of our commitment to right the wrongs."

Though HUD oversees a relatively small number of abandoned and vacant homes -- about 40,000 at any given time -- experienced contractors said the same issues are at play throughout the industry. Bruce Davenport, a Georgia contractor who fixes up vacant homes, estimated that 70 percent of the properties he visits show signs of jobs half-done, or not done at all.

Sometimes the evidence of misconduct is apparent to anyone who happens by a foreclosed home.

In Lehigh Acres, a Florida exurb among the hardest hit by the foreclosure crisis, police arrested Don Zilen in 2011 after he admitted to illegally dumping more than 10,000 pounds of trash that he pulled out of two homes into the backyard of a vacant house near where he lived.

According to a pay record for the job -- which Zilen also unwisely dumped -- Fannie Mae had hired Cyprexx Services to clean out the houses. Cyprexx hired a local company, REO Proz, which hired Zilen.

Adam Reynolds, the former owner of REO Proz, told HuffPost that licensed dumpsites charge to accept waste, so Zilen likely calculated that he could save a few hundred dollars by emptying the trash in someone's backyard. Reynolds said that Zilen had passed a background check, but acknowledged that he did not perform such checks on all subcontractors. "Sometimes we hired them on a whim," he said.

'REASONABLE EFFORTS'

The failure by the industry to consistently vet contractors echoes practices that led to past investigations and rule-changes. In 2005, for example, a South Florida Sun-Sentinel investigation found that government inspectors entrusted to verify damage claims for the Federal Emergency Management Agency included criminals with records for embezzlement, drug dealing and robbery. FEMA subsequently tightened its screening requirements.

HUD did not respond to requests for comment about what steps the agency takes to vet its contractors. Broadly, regulations that govern federal contracts require "reasonable efforts" to not include an individual as a "principal" whom "due diligence would have exposed as having engaged in conduct that is in conflict with the contractor’s code of business ethics and conduct."

In the case of one Atlanta field services company, a simple background check may have prevented what some contractors allege was a short-lived, but costly scam.

Brandon Lambert and his business partner, Jason Mathis, opened Premier Property Management Services last August using $70,000 in seed money from a local businessman, Mike Edwards, as starting capital.

Registration papers indicate that Lambert was chief financial officer for the company. He is also a convicted felon, having served two stints in prison for check fraud and forging documents, according to public records.

Over a three-month span, Lambert and Mathis hired contractors to clean and preserve hundreds of properties. In October, the company abruptly shut its doors.

Seven former contractors who maintained homes for the company allege that Lambert and Mathis owe tens of thousands of dollars for work that was done, but not paid for. Two of the contractors have filed claims in Atlanta courts. Edwards said that he hasn't recovered any of his investment money.

Premier Property was a middleman, or an "order mill" as some contractors call these companies. At least least half a dozen larger field services companies hired it to clean out and preserve properties for entities including HUD, according to contractors who spoke to HuffPost.

It's not clear what steps, if any, these companies take to vet the contractors they hire to carry out work orders.

Asset Management Services, or AMS, in Bristol, Pa., is one of the companies that hired Premier Property to maintain foreclosed homes, several contractors said. On its website, AMS boasts that its “highly skilled and trained property technicians manage thousands of assets across the nation.”

AMS did not respond to a request for comment. Beth Meade, a former AMS employee hired in the fall of 2011, said almost all of her colleagues were temporary workers earning minimum wage and that they received little training. She said she was assigned with one other worker to oversee a portfolio of 125 properties in northern Florida owned by the Federal Deposit Insurance Corp., which had taken title to them after a bank failure.

Meade said she hired contractors to inspect and preserve homes by searching “general contractors” and “Florida” using Google. She said she didn’t know if the contractors she hired had criminal pasts or whether they were licensed to do repair work -- or even whether there is a licensing requirement in Florida.

In an interview, Edwards said that he should have known better than to loan Lambert and Mathis money without better vetting their backgrounds. He said that he cut off the funding after it seemed clear that Lambert was "making up numbers." He said he did not expect to be repaid and that he is not pursuing legal action, having concluded it would be fruitless.

Opinions differ on what happened: Edwards said he thinks Mathis and Lambert were simply bad businessmen; former contractors told HuffPost they believe the pair intentionally cheated them.

After Premier Property collapsed -- or was looted -- Mathis and Lambert appear to have stayed in the Atlanta area.

In December, a Georgia company called American Contracting Consultants Inc. listed Mathis as its "registered agent" in public filings. Antwane Adams, also listed as a registered agent of the company, told HuffPost that he is a childhood friend of Mathis. Adams said the business came about after Mathis approached with an opportunity: If he and his wife would pitch in just a few thousand dollars, Mathis and Lambert would help them launch a new business in the property preservation industry. Adams said he did not know anything about the industry prior to the proposal.

In January, Adams said, he began hearing from contractors who claimed the two men owed them money. When confronted with the allegations, Mathis and Lambert "up and disappeared," Adams said, taking with them tools and other equipment.

Adams said he was working to remove Mathis's name from registration documents. "We've been getting a lot of grief about this," he said.

I hope to continue . I have alot fo great friends and resources. My biggest wish is to save as many as I can . What is happening to our country and its people is just so sad and so wrong. Thank you for stopping by .

ReplyDeleteWow! Nice information. There is wonderful on "Fraud and abuse Property maintenance companies". I am intimidated by the value of in progression on this website. There are a lot of excellent assets here. Definitely I will visit this place again soon.

ReplyDeleteI think, We see our home as the ultimate place of relaxation, a place where we can revive our spirits and feel rejuvenated.

Here is some helpful information about maintenance service.